Management Control & Custom Buckets

Another look at your P&L

Hi everyone,

This is Younes from The Family.

I hope you enjoyed last week’s long-form edition of Chasing Paper about the gaming industry.

This week, we’re back to normal with a topic of prime importance for CFOs : the income statement and tools to look at it differently.

One of the first things anyone who takes a small interest in finance learns is how to slice up a P&L.

It’s an essential step in properly understanding how to go from revenue to net income: what activities brought in revenue and what costs were incurred in doing so. And naturally, there are ancillary items that one needs to know because they can be compared throughout the industry: gross margin, EBITDA, EBIT, etc.

Yet, however important those items may be to understanding the overall health and economics of your business, they are poor indicators when it comes to management control. Very often, common indicators and cost items are not tied to operational realities - instead, they are just vague aggregates that do not provide the right insights to make informed decisions.

For instance, SG&A (for Selling, General & Administrative Expenses) is the sum of all direct and indirect selling expenses and all general and administrative expenses not tied to a specific product. What should you do if your SG&A grow over time? Well there’s no clear answer, because apart from saying your overhead is increasing, you don’t know the cause of that increase. You need to go deeper. And of course, you can do that by manually retrieving the items that make up your SG&A, but it’s tedious, painful and error-prone.

What I suggest is having a secondary dashboard that automatically slices up your P&L into buckets you’ve specifically designed. That way, you can dissect your earnings and costs in a much more efficient, decision-oriented way. And if you have been following previous editions and know my love of Finance Hacking, you also know that my tool of choice to do that is AirTable.

An example

Let’s say you’re running a company in the UK that sells software: you make revenues through monthly licence fees (MRR) and set-up fees. You have 2 team members, an office in the UK, pay taxes, and use software to help you develop your own solution.

You could use AirTable to build a table to define your custom buckets:

All of these 👆 are individual buckets to which you can later link transactions (i.e. if you have 1,000 new clients this month, there will be 1,000 individual transactions entering the new MRR category). I visually categorized them by Revenue / Costs and by “stream” for you to see how easy it is to categorize.

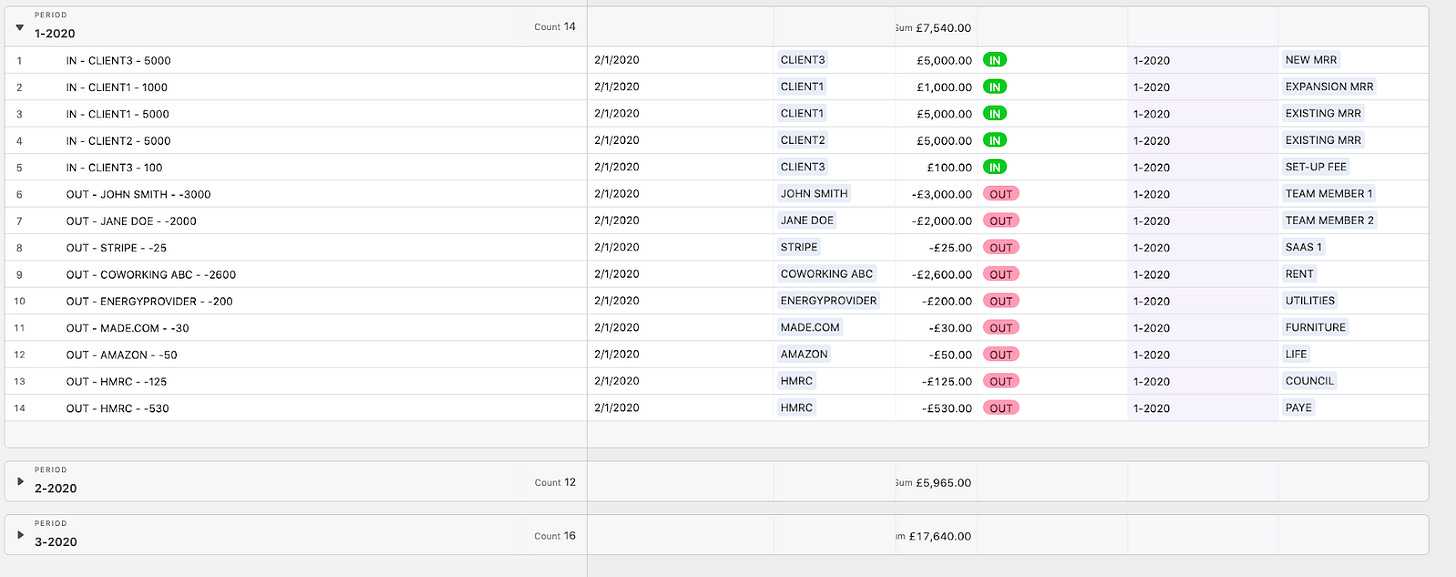

You can then proceed to feed another table with all of this month’s transactions (either manually or, of course, by automating through APIs - but that’s for another edition 😉), which would look a little bit like this:

Once you’re there, your Custom Bucket Management Control dashboard is ready. You can, for instance, see a revenue and cost breakdown over 3 months:

And from there, you can make business-oriented observations, such as:

We had no new MRR in Feb ’20

Our SaaS costs increased strongly in Feb ’20 and went back to normal in Mar ’20

And since AirTable is a dynamic, automated tool, if you’re puzzled by this discrepancy, you can just click on the bucket of your choice and access the details of all items that went into it. So if I click on that orange bucket in the costs of Feb ’20:

I can see that there was a £1,000.00 fee paid to Stripe - which allows me to (i) recognize where the issue comes from, (ii) understand why it exists by asking the right team/team member what happened and (iii) take the proper decision.

All of this can be automated so that you don’t have to lift a finger and it happens instantly. It truly gives CFOs superpowers.

I think the best application has to do with management control: being able to see what happens in the company's finances exactly as you expect. But you can find multiple additional ways to use this:

If you’re preparing reportings, you can automate them

You have due diligence material always at the ready for investors

You can assign duties to your team members based on the buckets you create (e.g. for SaaS, you can create a monthly “please upload your invoices” routine)

In an ideal world, you could pool cash reserves to the right bucket through banking APIs (we’re not there yet, but our infrastructure is ready ;))

The list goes on and on - it’s basically a platform to build upon and improve your financial management.

If you feel like toying around with the base and example above, here are the links to the 2 bases I used: buckets and transactions.

In the papers 🗞

This section discusses finance-related readings I enjoyed recently.

Marc Rubinstein’s Net Interest has rapidly become one of my favorites weekly newsletters. With only 6 issues so far, there have been tremendously interesting things, like how the balance sheet of financial institutions dictates how they operate, a long-form profile of JP Morgan CEO Jamie Dimon and a clever tentative explanation of why the stock market keeps soaring amid a crisis and what it has to do with entertainment. Give him a follow!

Bill Ackman, Pershing Square’s mogul-CEO once famous for his bad short trade on Herbalife, in in-the-money again and has big ambitions: he has filed for a $3bn IPO to raise the largest ever SPAC (Special Purpose Acquisition Company). For those of you unfamiliar with SPACs, they are publicly traded “blank checks” companies that acquire and merge several holdings into a champion. Interesting developments to come :)

For long-term macroeconomic perspectives, I like to read Oaktree Capital’s Howard Mark’s prose. His latest essay to date dissects the current market rally with interesting takes and insights on large scale global trends.

Payment in Kind 🎁

If you enjoyed, share this newsletter and make sure to subscribe if you haven’t👇

And for this week’s pop culture reference, I recently started reading a lesser-known novel by French author Jules Verne, The Adventures of Captain Hatteras. It tells the story of a bold English expedition to the North Pole.

As I was reading the vicissitudes of this crew, investing capital before departure, operating in complex frozen waters, facing internal dissension, I remembered how finance and maritime exploration or commerce were tightly connected.

Insurance, public offerings, and even venture capital can be traced back to needs of sea explorators. And that got me thinking - or rather, daydreaming: with SpaceX successfully launching the first-ever manned mission by a private company, interstellar exploration could become the new frontier. And with it, new kinds of innovative financing. I wonder what they could look like 🛰

Meanwhile, I’ll be reading part 2 of the Adventures of Captain Hatteras ;)