Hello :)

In this first issue of Chasing Paper, I would like to discuss what to me is the most important outcome on business finances of the ongoing Covid-crisis: entering a post-fixed costs economy, and what it means for both existing companies and coming startups.

Uncertainty: Nobody knows nothing

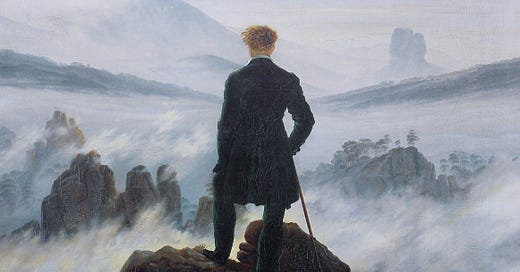

Navigating uncertainty is like wandering into a sea of fog …

There is little truth in the world of business and investment: nobody knows what the future holds, we’re just guessing. Sometimes, when the conditions are right, we can look at past data, analyze it, infer things, draw conclusions and be led toward good decisions, or at least the most rational ones.

Today, amidst an unprecedented crisis of supply & demand, those conditions don’t exist. Uncertainty is the marker of times: we don’t know shit, nor can we rationally assess future outcomes in our businesses.

Therefore, my take is that the only rational stance for a decision-maker is to accept this Socratic quantum state and deal with uncertainty in a simple way: by shortening time horizons and optimizing for cash. Taking decisions that do not create constraints and cannot become sunk costs, technical debt, or time lost is paramount. It means playing things by ear. We don’t know what is going to happen, so we can only focus on what is happening.

A Post-Fixed Costs Economy

Let’s take a broad view and say a fixed cost is a cost that does not change over the short/medium term. Rents, utilities, interest expense, salaries, these can all be considered fixed costs.

The reason why we’re in a post-fixed costs economy is that most costs (almost any) that cannot change over the short term do not make sense in the face of such uncertainty. It’s better to set them off or rearrange them to become variable, unless they are essential to the core business, i.e directly linked to your revenues and cash output.

Most fixed costs are burdens, and they’re heavy burdens when your revenues are being slashed (or destroyed). I’m sure the vast majority would agree you should avoid making decisions that create new burdens in times of uncertainty. Still, what about decisions that were made before uncertainty increased? I’d say that it is also a decision to hang on to those costs, and one that’s usually justified “because they were here before”. In times of high uncertainty, all costs are sunk, all of them can be questioned, and lots of them should probably be set off.

So what’s different this time around? Isn’t it the same in all crises? Fixed costs get unplugged and replugged all the time.

Here’s the thing: I believe we’re in a post-fixed costs economy, rather than just another instance of crisis cash management, because technology now makes it possible for companies to keep growing while lowering their fixed costs structure. It is viable to kill some fixed costs that had always been inherent to growing a business.

Signs of a post-fixed costs economy are all around us: companies switching to full remote, increased reliance on independent workers & freelancers, on-demand software where cost matches usage, are all creating lean financial structures for growth.

With fixed costs disappearing, aspiring entrepreneurs can ask some very interesting questions:

HR costs are a primary concern in the post-fixed costs economy: how do you reconcile flexible headcount management and societal challenges of high unemployment and/or labor law? Consulting firms expect hundreds of millions to be unemployed globally, with employment levels recovering at best in Q4-21. What opportunities are there to improve everyone’s economic welfare given increased unemployment, independent work and uncertainty? (If you’re interested in the topic, I highly recommend my colleague Nicolas’ amazing book Hedge, calling for a new safety net protecting individuals and businesses in a changing environment.)

Rent is sitting next in line. Office spaces are a burden that can drag down even expanding companies. And what used to be regarded as a nice but impracticable way of working - full remote work - has been tested and tentatively approved at large scale through the forced experiment of the Covid quarantine. Yet the office is also the space where social work happens. Informal discussions, person-to-person contact, office design are the cement of company culture. What does all that look like without offices? How can we reinvent them? Plus, what about client meetings? What about team retreats? What about the challenges of having thousands of employees working remotely: insurance, cybersecurity, supplies, energy consumption, etc.? Is partial-remote viable?

There’s a swarm of new business challenges and models to invent for ambitious entrepreneurs.

Impact on financing & capital structures

At the macroeconomic level, entire industries, notably those with a high fixed costs structure, are endangered by a post-fixed costs economy. This is already visible in several industries: oil is in oversupply, and markets are preparing for a tremendous cut in production. Listen to the BP CEO confessing he has no idea what will happen on his market and therefore focuses on things he can control (cost, capital, etc.).

Among other examples, airline holdings were dumped by the father of all value investors, Warren Buffett himself (“the world has changed”, he said). Real estate companies have suffered previously-unheard-of losses and are still wondering what utilization rate they will be able to find post-lockdown.

Now, I am not saying all Capex-heavy, cost-intensive industries are doomed. As an example, hopefully the Coronavirus pandemic episode will lead us to invest more heavily into health systems. Hopefully a wish to live in a greener environment will push us to take the appropriate measures and invest heavily into greener technologies and industries. These are high fixed costs industries. So what we might see is a reshuffling of priorities when it comes to capital access for funding those high fixed costs businesses.

And with investors becoming ever pickier about deploying cash in capital-intensive businesses comes an important question for entrepreneurs: how can we leverage technology to reinvent business models with a leaner cost structure and a finance-savvy approach? What WeWork, AirBnb and Uber inherently had with cost flexibility in their economic models, they lacked in financial discipline (the latter two eventually came to have a firmer grip over their finances, whereas the former… well).

My view is that the economics supported by venture capital over the past 10 years (high growth, high cash burn, blitzscale) will start meeting typical private equity issues (EBITDA, cash conversion, self-financing capacity) earlier in the company life cycle. Mastering the mix will even become a competitive advantage: CFOs are going to have an important role from the get go.

A post-fixed cost economy is one where the necessary growth startups seek to transform entire industries is compatible with the financial discipline of building a sustainable business at scale.

I hope you've enjoyed this first edition of Chasing Paper. The next one will be more hands-on and tool-focused, but I felt compelled to start with a perspective that gives you an idea of how I'm looking at corporate finance right now.

If you liked it, make sure to share it — or subscribe if you haven’t.

Some people might see this view as overly paranoid, but given what the world is living through, I think it'll turn out that Andy Grove wasn't just a great business leader, but also a prophet: Only The Paranoid Survive ;)