Hi there, Younes here. Long time, huh?

In the past year, I’ve been busy working as a fractional CFO for a couple of startups or funds, but I’ve also co-founded an investment firm - OPRTRS (pronounced ‘operators’) - with my partners in crime Christophe & Noé.

If you know me (or if you read the last few Chasing Paper editions), you’ll know I love transparency, building in public and sharing the roadmap. So, in the spirit of Musk’s “secret” Tesla masterplan, I wanted to elaborate on the OPRTRS playbook and how we plan on redefining pre-seed investing. And sure, it’s not really secret – but after all, if Elon can manifest his vision by writing it, why shouldn’t I at least try?

Also, get ready for a lot of sports and Lord of the Rings references, because operating at the crossroads of an elite athlete team and a fellowship of determined friends just brought it out by itself (kind of).

The New (Pre-Seed) Deal

Let’s set the stage first.

We are in France, and currently we see the French tech ecosystem entering its Third Age.

But what happened in the First and Second Age? Well, in a hole in the ground, there lived a hobbit … sort of. When it comes to tech, an engineering-heavy education system has made France a stronghold for technical talent since the dotcom era ; however in the First Age that talent was lacking (i) sufficient venture capital allocations at the early and growth stages and (ii) an entrepreneurial mindset to go from zero to one, and one to a thousand.

The 2010s bridged the gap phenomenally, some successful entrepreneurs (X. Niel) and mafias (Exalead, Stupeflix, Fotolia) from the First Age paved the way to attract capital & business-savvy talent to the startup scene and to instill an entrepreneurial mindset onto French founders.

This led to a flock of successful businesses and pioneering ventures, among which: Algolia, Datadog, Dataiku, Alan, HuggingFace, Voodoo, Qonto, Zenly, Sorare, Aircall, Mirakl - and a new generation of entrepreneurial talent and angel capital ready to fuel them.

We see the Third Age tapping into those more recently acquired strengths and expanding on what sets France apart:

deep technical expertise on frontier topics, including AI obviously but also bio-and-medtech, cybersecurity, web3, energy & climate, spacetech, robotics …

a knack to build superior products: strong teams able to compete on product “plays” where product maturity needs to be very strong before selling, not only in consumer but also B2B (e.g : Upstream, Twenty, Jitter.video - that have the potential to be future Looms, Notions, Figmas …). This is especially relevant in a world where Product-Led Growth and Product-Led Sales are all the rage in go-to-market strategies.

swift entrepreneurial execution and global ambitions from day 1: ambitious founders now understand that they need to expand to the US very fast (often at or before Series A) and know how to find advice and talent in the market to hone the internationalization playbook.

the emergence of a top management layer brought by thriving scale-ups. We now have seasoned operators who are ex Apple, Stripe, Dropbox, or Spotify coming to work in French startups, and their playbook ripples through the ecosystem. We also have talents who have seen first-hand how to build and scale a tech company from France and onto the wide world.

And the funding landscape? Well, historically VCs were the gatekeepers of early-stage funding, writing the bulk of checks, with a bunch of business angels who weren’t accustomed to the startup ways offering more than unfair conditions at pre-seed. But thankfully the landscape shifted, with more capital, local and international VCs specialized in pre-seed/seed and angels who provided fairer terms.

Yet, the shift is not over: more super-angels and very-early-stage specialists are pooling capital, and guess what? They’re pulling off rounds without the need for traditional VCs. These angel syndicates are smart, they’re nimble, and they’re building a new normal at pre-seed: a world where founders raise directly from (i) risk-takers who know how to bet on a team very early without optimizing for ownership and/or (ii) the people who truly understand their industry and are ready to roll up their sleeves to help. No red tape, no fluff, just cash and know-how.

Brains Wanted

Enter the operator-investors. These folks? They’re the real MVPs of tech.

Who are they? C-levels, VPs, Head of, Chiefs of Staff, General Managers, Country Managers, Directors, Leads, early employees … They’re the executive fringe of startups and scale-ups. Those are women and men that know their stuff, top talent who’ve got deep expertise, battle-tested scaling skills, and know the latest playbooks in-and-out.

In the tech ecosystem, they’re invaluable. You don’t have to trust me, just see what those founders have to say about them:

"French Tech operators are the craftspeople of our ecosystem, those who know the ropes and will be the entrepreneurs of tomorrow. Without them, Tech loses its soul"

Charles Gorintin, Founder & CTO @ Alan

"Operators are those women & men working hard in the shadows of a cofounding team”

Anh-Tho Chuong, Founder & CEO @ Lago, ex-operator @ Qonto

"They are the pillars without whom the tech ecosystem would collapse”

Antoine Martin, CEO @ amo, ex-founder & CEO @ Zenly

And indeed, entrepreneurs have started to realize the value that operators have, not only as their employees, but also as investors in their cap-tables. It’s increasingly common at pre-seed to have founders chase tickets from a handful of very capable operators from companies operating in the same space (for their industry knowledge) or with top-notch expertise in a key function for the venture they’re building (e.g a VP Sales for an Enterprise B2B SaaS which is by nature a sales-driven play).

Operator-investors are wanted and sought-after. But here’s the catch: their day jobs are intense, and there are only so many hours in a day.

The 110-meter Hurdles

Indeed, here’s where we hit a reality check.

While operator-investors might just be the MVPs at the pre-seed stage, they still have got to clear a few major hurdles. It’s not a sprint; it’s a 110-meter hurdles race. If you’ve ever watched the Olympics, you know how it goes: the runners take off, looking slick and fast, but they’re bouncing over obstacles every 9 meters, and by the last hurdle, the legs are getting shaky. That’s what it’s like for operators trying to break into angel investing.

Let’s break down what’s standing in their way:

Capital: While operators usually have (very) high salaries and sometimes even a cushy bonus, the truth is, they’re not exactly Scrooge McDuck swimming in pools of gold coins.

Even if they’ve got stock-options in their company, their equity is often tied up and illiquid – and in the rare cases where they cash out, personal projects are obviously prioritized: wedding or baby on the way, world tour, buying property …

As a result, most can’t throw four-or-five-figure checks at startups on a regular basis, even if they’d love to. They’ve got rent, maybe a mortgage, and definitely some healthy dose of Parisian croissants to fund. The idea of putting up 5-25k regularly just to get involved in deals is unrealistic for many of these high-potential but budget-conscious stars.Dealflow: The best opportunities don’t just come knocking. In the startup investment world, the juiciest deals go to those with an ultra-strong network. The irony? Our operators are so busy scaling companies, hiring, and fine-tuning their skill sets that they don’t have the time to network their way into every startup event. So, while they have insider knowledge and the brains to spot a future unicorn, they often miss the boat because they don’t see the deals early enough.

And the double Kiss Cool effect (sorry for this very French reference) is that for lack of dealflow, even if they are willing to dabble in angel investing, they can’t diversify enough to moderate their risk.Time: Speaking of time, operators are stretched thin. Their days look like some complicated multi-level Jenga game where every block is another meeting, team review, one-on-one with a direct report or KPI to track. And when the day is over and there are no more meetings, that’s when the “real work” starts. Plus you know, personal life and everything. They’re not just “busy”; they’re “so-busy-they’ll-merge-with-their-laptops” kind of busy. Finding time to evaluate startup pitches? Most operators would sooner jump off a proverbial cliff than take on more responsibilities. They want to invest, but the commitment is daunting when they’re juggling a job, perhaps a family, and maybe a few extra side projects.

Incentive Structure: The operator’s investment incentive structure is, frankly, lacking. Traditional angel investing can feel like running a marathon but being told you only get a medal if everyone else in the race gets one too. Operators have so much to bring to the table, but without meaningful carry or the right upside, why would they put in their valuable time? Investing a couple of small tickets, sweating it out with the founders to maybe get a serious multiple on one of the lines if they picked correctly (and that’s a big if). They might like the idea of angel investing, but without a real “win” in sight, the sparkle fades fast.

Know-How: Lastly, angel investing isn’t something you can jump into without a plan. It’s a bit like cooking a soufflé: you need the right ingredients, tools, and timing, or you’ll just end up with a flat pancake of lost capital - believe me, I tried: so far I have 0 soufflés and not many more significant exits. Our operators have top-tier skills, yes, but angel investing is a craft of its own. They’ve mastered the scale-up game, but putting together a successful angel portfolio requires a different set of strategies.

So indeed there are important hurdles that make the leap from operator to operator-investor feel like a struggle. Sure, they’d make stellar angel investors, but most operators stay on the sidelines because of those painful elements.

OPRTRS: The Fellowship in full swing

Ta-da! This is where OPRTRS steps in, with a game plan to clear the hurdles and bring more operators to the investment world. On your marks, ready, set, let’s go!

We like to think of ourselves as a Fellowship of Operators. At the most fundamental level, OPRTRS is a community of top tech talent gathered by a will to share their expertise and skills with fledgling companies; as well as investing together.

Indeed, by gathering expert talent and pooling capital into a common vehicle, we can alleviate all the barriers standing in front of the operator-investors. We aim to empower the best operators in tech to finally become the investment force they were meant to be, and have fun while doing so.

What does it look like from the inside?

A. Simply the Best

We’re not just looking for people who can write a check; we want people who’ve been deep in the trenches - or should I say deep in the heart of Mordor.

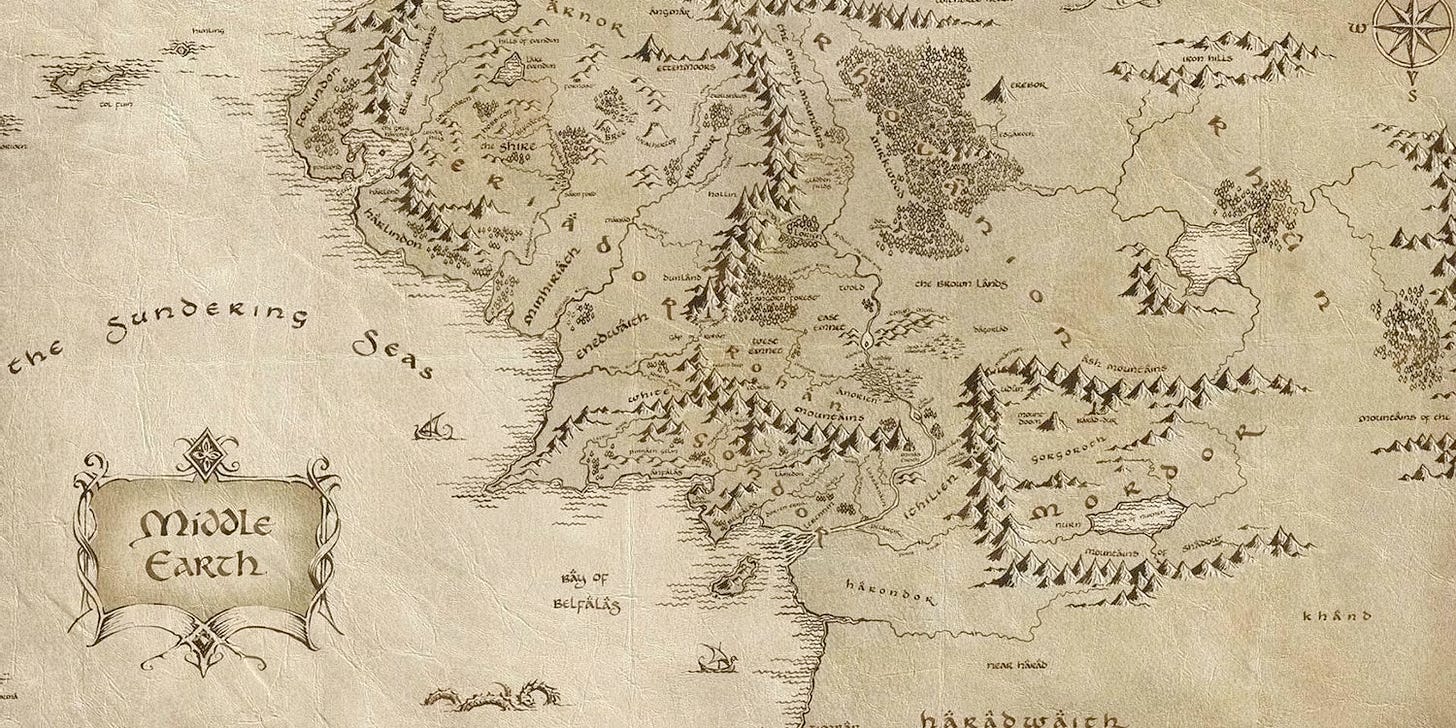

The C-levels, VPs, Heads of Product, and rockstar operators who don’t just understand the industry; they are the industry, and we want them to come from companies where they have been witnesses of grand successes. Below are some of the current or alumni companies where our 80+ operators to date have officiated.

But don’t think we just go logo-hunting. We’re after people with battle-tested experience and handpick our operators for the wealth of knowledge they have. They’re the ones who’ve taken products from 10 to 100, who know what it takes to scale, who’ve been in the war rooms, facing clients, upgrading interfaces, scaling the back-end, managing the workload, hiring the cogs in the machine. They’re not just smart; they’re in the know, which means they can bring real value to the startups we invest in.

B. We Alleviate Their Hurdles

Capital: We don’t ask for big checks. Operators can come in with smaller tickets, and we match their investment with more traditional LPs who bring larger sums for leverage. As the great Muhammad Ali would put it: “float like a butterfly, sting like a bee” – get the best of brains and capital together and the impact is massive.

Dealflow: By combining all of our extended networks, operators get to see premium dealflow they wouldn’t otherwise access. They’re very well positioned to know when one of their colleagues is going to leave and “work on something new”, way before VC analysts get the warning by a LinkedIn update. They might even get on to build something themselves. As a result, our community gets the chance to look at startups very early, across industries and that align with their expertise and interests, so they’re not just getting deals, they’re getting smart deals.

Time: We know operators are strapped, so we handle the background work. From scouting to sourcing to vetting, our dedicated team takes on the heavy lifting. Operators can swoop in where it matters: engaging with founders, sharing insights, and making their presence felt without needing to be glued to a pitch deck.

Incentives: Here’s the kicker: there’s real skin in the game. All of our operators chip into the investment vehicle, making it structurally in their interest to contribute to the success of our portfolio companies. Not only that, but operators who roll up their sleeves also get a generous slice of carry, turning their contribution into a genuine partnership. They’re not just “adding value”, they’re getting a return on the value they create.

Know-How: Finally, they’re not stranded out there without a playbook. Our team consists of VC professionals guiding and handling the process. We have the tools, the resources, and the guidance to make solid, impactful investments and take care of everything in the back-office.

C. We Offer Clear Value to Founders

For founders, raising from OPRTRS isn’t just getting capital. It’s getting access to a strategic, power-packed community. OPRTRS doesn’t come in as a single check; we’re a constellation of expert operator-investors. I like to say that we’re a proxy investment for 100+ top minds, but you can think of it as getting the Avengers onboard your cap table, each bringing their unique powers to the mix (can’t use Gandalf & Legolas every paragraph, can I?).

Semi-decentralized VC

You often read about clubs or communities proudly stating that they’re essentially decentralizing Venture Capital. While to some extent making the claim and pushing an agenda towards its realization is progress on the market, there is still some advantages to having a centralized investment firm to deploy capital in startups.

We see OPRTRS as getting the best of both worlds: the extended platform and the stable structure.

Indeed, we’re essentially structured around a community model that taps into the raw power of operator talent and networks and that makes us better at investing in early stage.

Better Sourcing: With our network of operators, we don’t just wait for deals to fall in our laps; we’re actively out there, uncovering gems naturally. Our community-driven approach means we’re tapping into networks that traditional VCs only dream about, and we increase our chances of stumbling upon one of those very few founders each year that is going to build a generational company.

Better Screening: The collective experience of our operator-investors means our screening process is rock-solid. We don’t just assess ideas and teams; we can drill down to assess technical edges, strategy, viability, scalability, and all of the intangibles only operators understand.

Better Winning: Picking OPRTRS for a founder isn’t hard to do. It’s not a leap of faith to uncover later whether there is value-add or actual industry knowledge beyond capital. When a founder is picking OPRTRS, they’re choosing more than just capital. They’re choosing direct access to and a seal of approval from the industry’s top talent. This isn’t just money, it’s a strategic alliance.

Better Supporting: Unlike many VCs, our post-investment support is in a league of its own. With a community of operators at the ready, founders get access to real-world expertise, on-demand, and from people who’ve done the job themselves.

That’s the decentralized part: our community doesn’t just make us different; it makes us better. But we also pride ourselves in having a stable operation by centralizing a lot of the process behind the scenes: there’s a team of seasoned investors who handle the heavy lifting. Think of us as a VC engine running in the background so operators can focus on delivering their expertise to our portfolio without getting bogged down.

We take care of everything: dealflow, due diligence, memo writing, fundraising, compliance, community management, operations to mobilize the right operator at the right time, legal, admin. Essentially, VC-as-a-Service. Our goal is to let operators zero in on their strengths: guiding startups, sharing their know-how, and driving real value, without sweating the back-office details.

With this model, we give operators the freedom to be as hands-on as they want with founders, while we handle the complex, time-consuming work to make investments and support seamless. It’s a setup that allows everyone to do what they’re best at, keeping the engine running smoothly and the impact high.

Building an Ecosystem Flywheel

What’s our secret you ask?

Our vision isn’t just for now; it’s for the future. Today’s operators? They’re tomorrow’s entrepreneurs. OPRTRS is about building a sustainable ecosystem: we gather operators, have them connect, invest in their ventures, and support their growth. In turn, these founders hire and train new operators, who eventually become the next wave of founders and investors. This is the long game: it’s about building a regenerative ecosystem that feeds back into itself, creating a perpetual cycle of talent, capital, and innovation.

And just like that, the flywheel spins.

There you have it: the “secret” OPRTRS masterplan. It’s big, it’s ambitious, and it’s rooted in building something that lasts. So, if you’re an operator, a founder, or someone who believes in what we’re building, welcome to the future of pre-seed investing. This is only the beginning.

Until next time,

Younès

If you made it down here, kudos! For those of you that don’t know, Chasing Paper is a newsletter giving my perspectives on finance, VC, strategy, tech & innovation - and how they interact. I haven’t been posting in a while as I was busy building but I plan to post more in the foreseeable future.

If you’re not a subscriber 👇

- COO: Boromir

- CTO: Gandalf

- CPO: Frodo

- Head of Marketing: Legolas

- VP Data: Gimli

- Chief of Staff: Sam

- Lead Engineer: Merry

- HR Director: Pippin

- VP Sales: Aragorn

Happy to discuss about it!