Hi everyone,

This is Younes from The Family.

Chasing Paper is a newsletter giving my perspectives on finance, strategy, tech & innovation - and how they interact. It’s aimed at CFOs and other people with entrepreneurial endeavors who are looking for tools and ideas to improve the handling of finances in their companies.

This week, we’re tackling an important topic for CFOs: working capital. More precisely, we will look at working capital in a macroeconomic context of low (very low) interest rates.

Disclaimer: I don’t think queens are less important than kings in any way. Please take the title of this article as what it is: a play on words ;)

Working capital finance

The most important item for any business is cash. It’s a lifeline, a metric for success, a basis for company valuation, and also a frequent cause of death.

So if your business has a long cash conversion cycle (i.e there’s a long time between the moment you spend money in order to sell X and the moment you get paid for X), you’re in a bad position. You need to finance your working capital, one way or another.

Very often, the biggest problem is getting the ball rolling: financing the first batch of product, or financing the initial user acquisition is tricky. Once you have them, you can finance (at least part of) your future inventory with previous profits. But initially, you need to find money to cover your expenses (usually with investors), and factor in the risk that you’re taking by experimenting with something new (product/market fit).

Fortunately, solutions exist to mitigate both risks (investors and product/market fit) at the same time.

My favorite one has nothing to do with finance in particular. It’s more of a mental toggle switch: if you’re launching something entrepreneurial, sell it first. Fake it until you make it: do a Kickstarter campaign and get funding, set up a landing page and start taking payments or subscriptions, make videos, get vocal. This is the best, most viable route: you finance by finding product/market fit (PMF). And if you don’t find PMF, well, maybe nobody was interested in the first place, so you’re better off not seeking financing.

That being said, there are multiple business models that require working capital to start and get growing. So what other solutions are there to finance working capital when you can’t just earn it with a sales pitch and some elbow grease?

The most common ones are well covered and well known: working capital loans, factoring, reverse-factoring (aka supply chain finance) or crowdfunding.

But there are also interesting growing trends that remain relatively unknown and deserve more attention.

Special purpose lending: what I call special purpose lending would almost fall into the loan or crowdfunding category, except it is often designed to finance one kind of business.

For instance, the French bank Société Générale has recently launched a 100% online platform dedicated to mobile game creators seeking financing for their user acquisition. What it is, in fact, is working capital financing, and it’s highly specialized to cater to a single category of risk that is typically higher than what a traditional bank loan would be able to serve (it also has more complexity than a traditional commercial banker would understand).

These new special purpose lending models are springing up like mushrooms in B2B (for instance, micro-credit for freelancers) and B2C (like companies that pay your salary in several installments throughout the month rather than all at the end of the month, thus avoiding overdrafts).

The case for financing a special-purpose lending company is attractive: an underserved market with a higher risk profile means (i) higher interest rates, (ii) limited-to-no competition from banks, (iii) customers eager to find a product tailored to their needs (esp. if it has a better UX than pitching your project to a bank clerk for the 100th time) and (iv) opportunities to leverage tech & data to optimize loan pricing.

The typical model to finance such a business would be to build a special-purpose vehicle and borrow the money from investors, and then price the final loans with a spread on the interest rate.

If you’re looking for business ideas and you’re not afraid of FinTech, then think about businesses that have working capital requirements, and how you could serve them with a specific product. I’m happy to hear about it :)Revenue-based financing: Clearbanc is an interesting company. They have a similar approach to special-purpose lenders (they only finance e-commerce businesses and are very data-driven). But they do so in exchange for a percentage of sales.

This is an interesting model to finance working capital: you can invest in user acquisition or inventory without diluting equity and your interests are aligned with those of your financer.

Equity: More and more businesses finance their working capital through equity financing. To me, this is a solution that should be avoided as much as possible. Obviously that’s not from the equity investor’s perspective, as we will see later, but it’s definitely so from the company’s perspective, because it either caps growth or increases dilution.

However, there are cases where the risk induced by the business model requires equity financing. Startups are experimentation labs and try new things, some of which are financially risky, with a completely upended business dynamic, e.g a travel marketplace where hosts are paid upfront and the platform assumes the risk of finding travellers and collecting cash later on.

And as pointed out by Bill Gurley in the linked tweet above, there’s a strong risk assumed by the platform: maximizing occupation becomes a matter of covering the cash cost rather than increasing revenue (a bit like a short position on financial markets). Plus growth consumes more and more cash, leading to further dilution round after round, all in order to finance growth.

Yet VCs keep financing those new kinds of models. And if you wonder why, keep reading.

Cash is Queen

Corporate finance lessons always teach that cash is king: one euro now is worth more than one euro in the future. Yet, in the current environment of low to zero (even negative) interest rates, cash is queen. The king now is an opportunity to invest cash at higher interest rates. That’s what gives businesses the upper hand.

First of all, it’s important to state that this section will move from the microeconomic standpoint (a company) to the macroeconomic one (the economy as a whole).

Second of all, you need to wrap your head around low, zero and negative interest rates. If you’re a bit masochistic, you can read this very thorough memo from Howard Marks that covers everything there is to know. Otherwise, the most brilliant piece I’ve read on the topic is this very entertaining article by Ranjan Roy from The Margins.

Low interest rates mean several things:

It means that capital will look for more yield. If that’s unclear, here’s how Ranjan Roy phrases it:

“So all these dollar-organisms all start swimming towards riskier waters. Treasury investors shift to corporate debt. Public equity hedge funds shift to late-stage private equity. Late-stage private equity shifts to mid-stage, mid-stage to early stage. Seed rounds become bigger. Angel investors become a thing. Unicorns, unicorns, and more unicorns. Ashton Kutcher.

And that's how we end up where we are. In the past, if somewhat risky corporate debt got you 10%. It now gets you 7% (I'm making up numbers here) so you start taking meetings with late-stage growth companies.”

The search for yield explains why it becomes easier for equity investors to finance risky business models with negative cash collection cycles and high working capital requirements, or why retail-to-institutional investors are happy to fund special-purpose lending opportunities.

They need more entrepreneurship and more risk to find yield for their capital.

But this also means that having working capital requirements is now an asset: the money you will collect in the future puts you in a better position than if you were cash-rich now, because it represents money at work. This is the reason why many, many entrepreneurs start experimenting with models with bad cash conversion cycles and have no trouble getting financed.

So if this macroeconomic environment of low interest rates continues, it will be no surprise that more and more investors will take their chances on financing a company’s working capital requirements through ever more refined and tailored special-purpose lending companies.

As Drake and Future would say, “What a time to be alive.”

Until next week,

Younes

In the papers 🗞

This section discusses finance-related readings I enjoyed recently.

I just found out about this newsletter by Jana Kovacovska called Tiny CFO, talking finance & strategy to entrepreneurs. You already know that blending pop culture and lingo with finance is dear to my heart so I was genuinely excited at the first issues. I think this piece on profitability is a great reminder. Give her a follow!

This piece by John Luttig was an essential read for me this week. As I mentioned in Uncertainty & a post-fixed costs economy, the 2020s are likely to require tighter financial control in startups. Luttig’s argument adds to that: the Internet’s growth perspectives are less promising, so we will start seeing zero-sum games and wars of attrition within software companies too. And what is needed in order to survive them is good financial management.

Alex Taussig from Lightspeed Ventures nerds out on cash conversion cycles, with an updated and recent comment. Bottom line: experimentations around working capital are appealing, but if you manage to have a solid business model with negative working cap, stick to it ;)

Payment in Kind 🎁

If you enjoyed, share this newsletter and make sure to subscribe if you haven’t👇

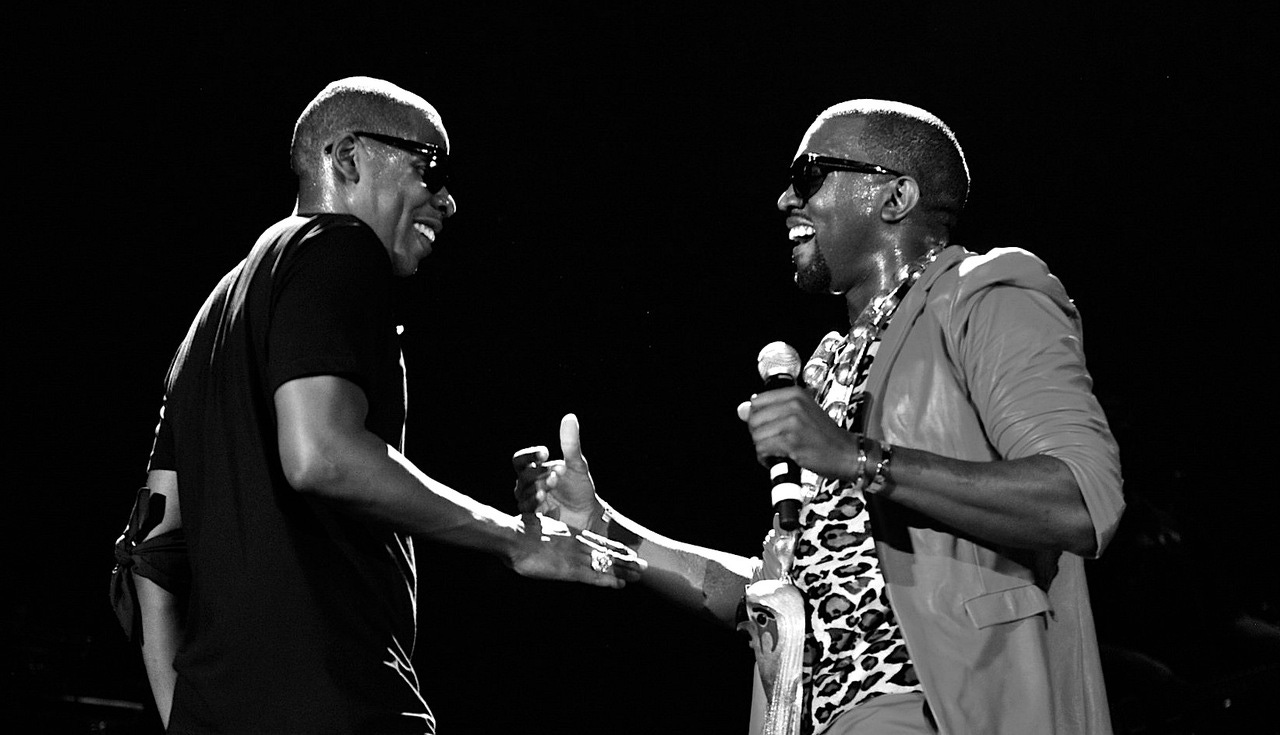

This section covers things I find in pop culture that somehow relate to finance. This week, I was referred to an excellent article dubbing rappers “walking business empires”.

The author argues, quite well so, that the likes of Jay-Z, Kanye West and Drake are applying business strategies to their careers.

I have myself been observing countless parallels between hip-hop and the business world for a while now. I think it is the genre where the dots are the easiest to connect because of (i) rapper’s tendency to talk & think about cash all day long, and mostly (ii) it being the main musical genre in terms of commercial success in the 2010s/2020s.

Incidentally, rappers emerging in 2020 do not copy the codes of business. Rather, it is business that copies the codes of rappers: building leverage and influence with a niche audience and growing from there. I won’t go into too much detail now, as this is a topic for a future newsletter ;)

Meanwhile, enjoy the only featuring between Drake, Jay-Z and Kanye West (the latter two credited together as The Throne).